For big-rig trucking, the fuel cell is where the future is.

Fundamentally, an electric vehicle is one that has replaced the conventional powertrain [based on an ICE] with one that’s using electric motors to turn the wheels. But what generates that electricity? You can either have a bank of batteries that you recharge with electricity that’s generated elsewhere, or you can actually generate the electricity on the vehicle using a fuel cell,” says Thomas Stephenson, CEO and chairman of Pajarito Powder, LLC, an Albuquerque, NM-based company that supplies a proprietary catalyst used to make fuel cells.

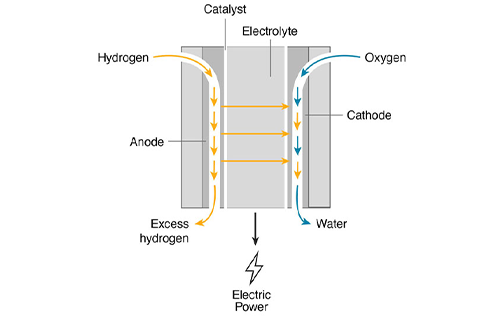

Within a fuel cell, hydrogen stored in a tank is combined with oxygen from the air, and through a direct chemical reaction accelerated by a catalyst generates electricity and emits pure water out of the vehicle’s exhaust pipe. Normally that catalyst contains a large amount of platinum, which makes fuel cells enormously expensive.

Pajarito Powder’s innovation for the catalyst is a special spongelike, carbon-based material enabling 50% less platinum to generate more power per square centimeter of surface area, cutting the total cost of the fuel cell system by 20% and making FCEVs more financially feasible, Stephenson says.

“For big-rig trucking, the fuel cell is where the future is,” declares R. “Ray” Wang, principal analyst and CEO of Constellation Research Inc., based in Palo Alto, CA. Both batteries and fuel cells need to be recharged — the latter in the sense that it requires refueling at a hydrogen station — and both can be swapped out for new ones, when necessary. However, “it’s a question of who can get which power source to a distribution point faster,” Wang says. Tesla has the capacity to produce battery packs and swap them in its Tesla Semi within 15 minutes, but FCEV truck makers like Volvo “will get there with fuel cells,” he predicts. That will lead to a race between the two technologies but “fuel cells don’t degrade” like batteries do and “fuel cells in the long run could actually cost four times less than lithium-ion batteries,” he adds.

The remaining challenge for fuel cells is to make them more efficient from start to finish, Wang says. “Only 25% to 30% of the energy [from the source hydrogen] makes it to the wheel of a fuel cell car,” versus 70% to 80% of the energy from a battery pack in a BEV, he says.

Wang highlights BYD, a Chinese company with a manufacturing facility in Lancaster, CA. BYD is the world’s largest producer of electric vehicles in the heavy industry BEV space. “They have a viable model, they have a viable manufacturing capability and they’re looking at a global footprint,” adds Wang.

In August, at the Advanced Clean Technology (ACT) Expo in Long Beach, CA., BYD unveiled two new BEV heavy duty truck tractors — the third-generation 8TT and 6F — offering up to 200 miles on a charge. The company says it is the leader in BEV truck deployments, with more than 8,000 trucks in service worldwide, including more than 200 in the U.S.

BYD, Tesla and Volvo Group thus exemplify the contest between fuel cells and battery packs in heavy duty trucks, Wang indicates.

One of the greatest advantages of FCEV over BEV for heavy duty trucks is the fueling infrastructure, which resembles diesel’s, says James Kast, a consultant at Toyota Motor North America’s research and development facility in Gardena, CA. Toyota began exploring fuel cells with a first prototype in 2017, a second prototype in 2018, and then the company debuted a “platform” demonstration truck with Kenworth at CES 2019. Now, the platform is incorporated in six Kenworth “Ocean” trucks distributed to customers who are using them regularly, as part of a test program operating out of the ports of Los Angeles and Long Beach, CA. They can travel 300 miles on a tankful of hydrogen, carry 80,000 pounds when fully loaded, and refuel in less than 20 minutes (compared with six hours to recharge an equivalent BEV truck), Kast says. Refueling time is expected to improve further, he says.

Likewise, Hyundai Motor Co. has embarked on a 12-month demonstration program in southern California using two of its XCIENT FCEV tractor-trailer trucks for long-haul freight operations between regional warehouses. U.S. model XCIENT FCEV “Class 8” trucks offer a maximum driving range of 500 miles on a tankful of hydrogen. The program began in August as a joint operation with First Element Fuel, (FEF) California’s largest operator of hydrogen refueling stations and will use three of FEF’s stations in the region to replenish the trucks. Hyundai also announced a separate program for northern California that will begin in the second quarter of 2023 and involve 30 XCIENT trucks, to be “the largest deployment of Class 8 hydrogen-powered fuel cell trucks in the U.S.”

Toyota’s subsidiary Hino has developed a light duty FCEV truck based on the automaker’s second-generation fuel cell technology for cars. It improves on the fuel cell’s power density, efficiency, weight and “packaging” — putting it up front where the engine normally sits — to “target diesel parity,” Kast says.

To be sure, fuel cells don’t obviate batteries, says Pajarito Powder’s Stephenson. He says, it is standard for any FCEV to contain a combination of a fuel cell and a battery, which is used for acceleration and energy saving features such as regenerative braking.

“You have to have batteries and fuel cells to truly meet the breadth of mobility solutions that’s required in the electrified world we’re headed toward,” says Charlie Freese, executive director of the global hydrotech business at General Motors in Pontiac, MI. “Today things that are moved by internal combustion engines that are gasoline driven tend to be well suited to battery electric propulsion systems. The bigger vehicles that have long haul requirements or heavy payloads where diesels operate today, will start to be replaced by hydrogen fuel cells coupled with batteries for regenerative braking.”

A tractor-trailer truck would have to jettison 22% of its payload to accommodate the weight of a BEV powertrain, but only about 3% for a FCEV powertrain, Freese says, illustrating hydrogen’s efficiency over batteries in this application.

Yet not every tractor-trailer truck needs a fuel cell powertrain or could be a BEV, and the expected haul makes the difference. “If I’ve got a truck full of potato chips, I might be able to live with a [BEV]. But if I’m moving heavy payloads — steel or water — that’s where hydrogen is providing its maximum benefit.” GM’s strategy has been to “develop a leadership position in both technologies and apply them where they fit,” he says. Besides trucks, GM is integrating fuel cell propulsion systems in locomotives and aerospace vehicles, Freese notes.

“When I think about the EV space, what I’m excited most about is that mid-market — where they’re doing the drops point-to-point between distribution centers to last-mile,” says Wang. He points to Workhorse Group Inc., based in Cincinnati, OH, and its C1000 BEV delivery van, which provides 100 miles of range, a 75 miles per hour top speed and 1,000 cubic feet of interior volume. “To me, it’s the delivery van of the future,” Wang says, “perfect for last-mile short hauls.”

“There’s a big future for all-electric in trucking, whether BEV or fuel cell, because fuel costs are so high,” says Celina Mikolajczak, vice president of manufacturing engineering at QuantumScape Corp., a San José, CA-based startup that is developing solid-state lithium-metal battery cells for EVs. “But you’ll see pretty quick adoption of batteries in delivery vehicles,” such as Amazon has begun to do in a test of BEV vans made by Rivian, she adds.

Learn how fuel cells can provide continuous power for long haul trucks at CES.

I3, the flagship magazine from the Consumer Technology Association (CTA)®, focuses on innovation in technology, policy and business as well as the entrepreneurs, industry leaders and startups that grow the consumer technology industry. Subscriptions to i3 are available free to qualified participants in the consumer electronics industry.