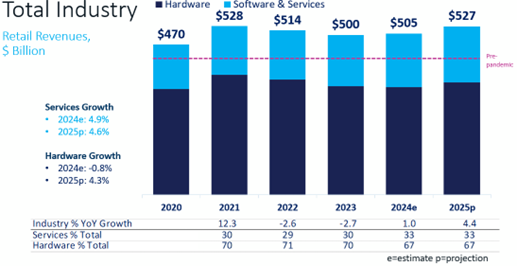

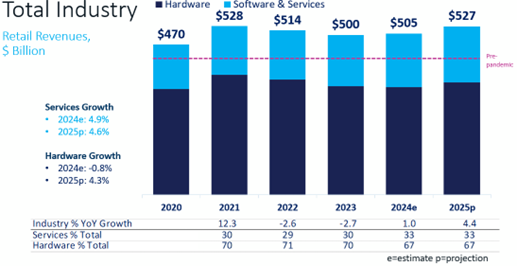

The Consumer Technology Association (CTA)® projects that despite a third straight year of declines in U.S. hardware revenues, overall retail revenues for the U.S. consumer technology industry will grow 1% in 2024 to $505 billion, followed by 4.4% growth in 2025 to $527 billion, according to CTA’s U.S. Consumer Technology One-Year Industry Forecast (July 2024). Services will help prop industry sales in 2024, before a potential bounce back year for hardware in 2025. More features plus falling prices in many technology categories reflect the deflationary nature of the technology industry on the domestic economy. Over 750 million connected consumer tech devices will ship to the U.S. market this year.

“Technology is deflationary by nature,” said Rick Kowalski, Sr. Director of Business Intelligence, CTA. “Value pricing of tech products like TVs, wireless earbuds and gaming hardware is impossible to ignore. Technological innovation helps industries explore more efficient strategies, fostering cost reduction and deflation. Looking ahead, we expect progress in artificial intelligence to spur growth in consumer and enterprise technology sectors, increasing efficiency and meeting more consumer needs.”

Total Industry Revenue from CTA’s 2024 Midyear Forecast

Deflationary Tech

Total Industry Revenue from CTA’s 2024 Midyear Forecast

Deflationary Tech

Overall U.S. inflation in 2023 reached +3.4%. In contrast, the following consumer technology products decreased in price that same year. Tech devices are among the most deflationary items in the U.S. consumer price index, consistently tracking below core inflation.

| Product |

Price change 2023 |

| 4K Ultra HDTV |

-12% |

| Smart doorbells |

-6% |

| Wireless Earbuds |

-5% |

| Home Gaming Consoles |

-5% |

Price changes from 2022-2023

Consumer spending on software and services makes up a third (33%) of total consumer technology. Six of the twelve major hardware categories profiled are expected to ship more units than 2023, including computing (+3.6%), digital health devices (+1.2%), and digital cameras (+6.2%).

Noteworthy Trends:

- Dozens of AI-enabled laptops will be released in 2024, with 53 million laptops shipping to the U.S. market, up 4% over 2023.

- Popular sporting events and greater availability of sports content across video platforms will push spending on live TV streaming services up 11% this year, to nearly $11.8 billion.

- A rise in cross-platform games, indie titles and growth in demand for subscription gaming services will drive gaming spending to over $50 billion, up 3% over 2023.

Methodology

Twice each year since 1967, CTA updates its forecast of more than 125 consumer technology products and services. This forecast serves as the benchmark for the consumer technology industry, charting the size and growth of underlying categories and the industry. It is used by manufacturers and retailers for creating product development plans; financial analysts for sizing market opportunities; industry and general media for providing context in their coverage; government staff for understanding the scope of the industry to guide policy decisions; and CTA itself for highlighting the successes and challenges of the industry.

Sign up for CTA Research Insights.

About Consumer Technology Association

As North America’s largest technology trade association, CTA® is the tech sector. Our members are the world’s leading innovators – from startups to global brands – helping support more than 18 million American jobs. CTA owns and produces CES® – the most powerful tech event in the world. Find us at CTA.tech. Follow us @CTAtech.